Myth: Filing for tax extension will result in penalties.Hence if you file for tax extension, it gives you more time to gather your tax information, prepare your tax information accurately and file it with the IRS without any corrections or amendments. Often there are times when there is a delay in receiving your tax information such as 1099 forms or form W2. For example: if you have already filed your tax return, and on a later date you receive amended information of your taxes, in return you will again have to file an amended tax return, thus incurring more tax liability and extra costs. Filing for tax extension in fact provides you with better opportunity to prepare your tax returns accurately and without having to file for amended tax return. Myth: Many people believe that filing for tax extension is awful.Believe me, IRS will not ask for any reason. You can file for tax extension anytime you want. Myth: Many people believe that if they file for tax extension, IRS would want to know the reason.

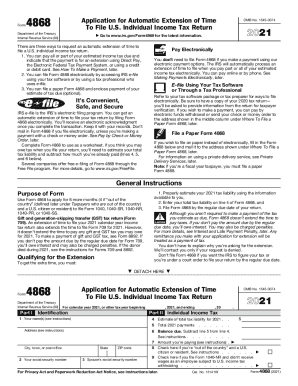

In other words, you can file for tax extension but if you owe any taxes to the IRS make sure you pay them along with the tax extension form. However, this does not mean that if you owe taxes to the IRS you can pay later. IRS allows you to file for tax extension so that you can have more time to prepare for your tax returns. Myth: Many people believe that filing for tax extension return, allows more time to pay for the taxes due to IRS.However, there are certain misunderstandings or myths which are to be cleared: Every year millions of people opt to file for tax extension.Estate (and Generation-Skipping Transfer) Taxesįorm 5558 Application for Extension of Time to File Certain Employee Plan Returnsįorm 8809 Application for Extension of Time to File Information Returnsįorm 8868 Application for Extension of Time To File an Exempt Organization Return. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment)įorm 4768 Application for Extension of Time to File a Return and/or Pay U.S. You can see if one of these applies.įorm 2350 Application for Extension of Time to File U.S. Now, if you do not fit under the above categories, below are the remaining possible forms to fill out for an extension. If you are a business or corporation, you will want to fill out a Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns) or Form 1138 (Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback). You will get a confirmation number for your records.

The IRS explains that by doing this you will not have to file a separate extension form.

Then indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or a credit/debit card. In addition, you can also get an extension if you pay all or some of your estimated income tax due. Otherwise, you can fill out the Form 4868, which is the Application for Automatic Extension of Time To File U.S.

#Tax e file extension 2016 irs free

If you would like to e-file for an extension via Free File Software, there are many options on the official IRS website. When filing for a free tax return extension, you will have six extra months to file your return, with Octoas your new deadline. How You Can Help Ukraine: Verified Charities, GoFundMe & Ways to Support Ukrainians

0 kommentar(er)

0 kommentar(er)